Background

NSSF Act 2013 was adopted in 2013. Labor unions filed a lawsuit to prevent it from taking effect in January 2014 as planned. After nearly ten years of legal wrangling, the Court of Appeal ruled in favor of the Act

Employer simple computation guidelines

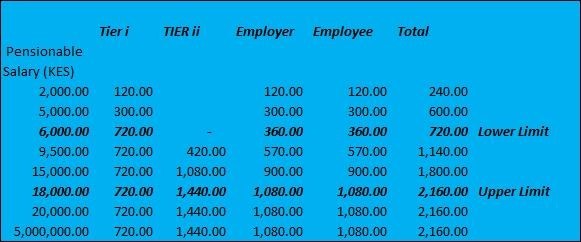

The Act requires employers to pay to the Pension Fund for each employee in their recruit as follows: (a) the employer contributes 6% of the employee’s monthly pensionable earnings, and (b) the employee contributes 6% of the employee’s pensionable earnings deducted from the employee’s earnings.

The Upper Earnings Limit (UEL) will be KES 18,000 as per the Act, while the Lower Earnings Limit (LEL) will be KES 6,000. The pension contribution will be 12% of the pensionable wages, divided into two equal parts: 6% from the employee and 6% from the employer, with a maximum contribution of KES 2,160 for employees earning more than KES 18,000.

Penalty for late payment and inaccurate contributions

If the contribution required to be paid to the Fund by a contributing employer is not paid on or before the prescribed day on which the payment in respect of any month is due, a sum equal to 5% of the amount of that contribution will be added to the contribution for each month or part of a month that the amount due remains unpaid, and any such additional amount shall be recoverable at the same time and in the same manner. Click here for more information.